Dec. 21st 2010

It has been said before, but now I think it’s official: retail forex has entered the mainstream. In the month of December, two retail forex brokerages – Forex Capital Markets (FXCM) and Gain Capital Holdings (GCAP) – went public on the New York stock exchange. Combined with some juicy information revealed in their regulatory filings, I think this event raises some interesting questions about the future of forex.

Some background: both FXCM and Gain Capital operate trading platforms and news/analysis websites (DailyFX.com and Forex.com, respectively). FXCM has a current market capitalization of $850 million, compared to $250 million for Gain Capital. The former earned net income of $98 million last year on revenue of $339 million, and it has 135,000 active clients. The latter earned $36 million net income on $188 million revenue, and its client base totals 52,000. (For the sake of comparison, consider that ETrade has more than $4 million and its ttm revenues exceeded $2.5 Billion).

If you do some simple arithmetic, you will discover that revenue per account is substantially higher for forex brokers than for stock brokers: $2,500/account for FXCM versus $100-200 that I’ve been told is standard for retail stock brokers. Of course, some of that disparity is natural, given that the average forex account-holder trades at a higher frequency and higher volume than the average stock investor, who apparently only makes one round-trip trade per month, on average. However, the bulk of that discrepancy is probably due to a lack of transparency/competition.

Although information on average account size was not released, it nonetheless stands to reason that a significant portion of forex account-holder equity is being “transferred” to brokers every year. (Interestingly, FXCM loses money on the majority of its accounts. Accounts worth more than $10K – which presumably do the most trading – generate the most revenue, and yet more than half of them are still unprofitable for FXCM).

I think this raises some serious questions about transparency in forex commissions. While other brokers make money from the bid/ask spread (which also suffers from a lack of transparency) and by taking offsetting positions, FXCM boasts that it “makes an identical amount of money in the form of pip markups (which are really commissions) regardless of whether the customer made or lost money on the account.” Basically, FXCM matches up buyers/sellers with banks and financial institutions, and takes a cut for facilitating the transaction. While this is somewhat less opaque than filling orders directly for customers, the fact that it doesn’t disclose its commissions should be cause for concern. For the sake of comparison, consider that when you buy/sell stock, the commission that you pay the broker is clearly disclosed.

Someone recently asked me if trading commissions (i.e. spreads) in forex were fair/stable, and in the context of this data, I think it shows that there are is still room for commissions to fall. As the number of retail forex traders grows, you would expect spreads to tighten further, and profit/account to decline from the current level of $700+ per year.

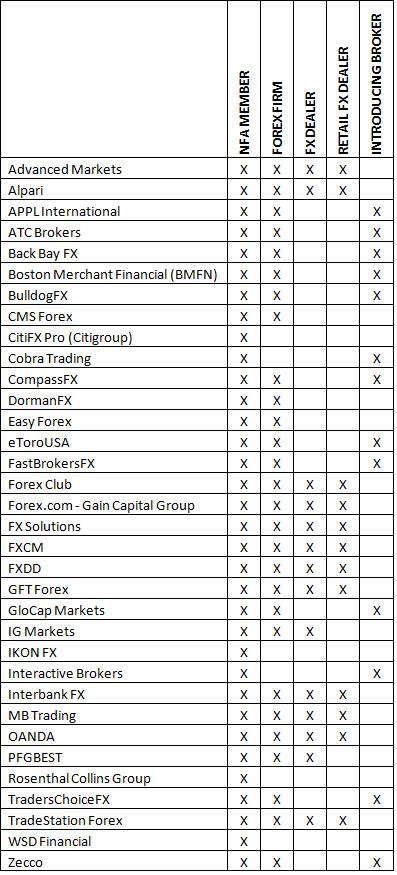

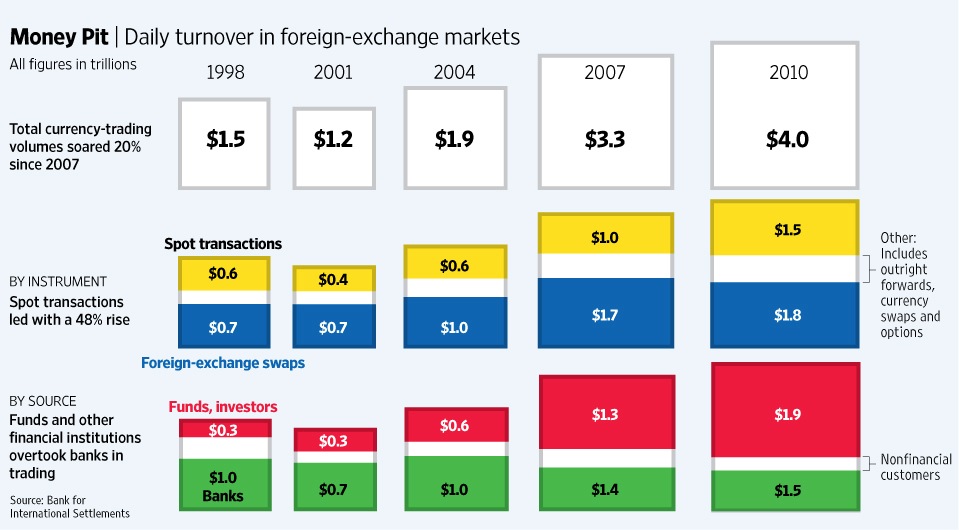

Since both FXCM and Gain Capital are now public companies, they will be subject to increased scrutiny and regulatory oversight, and will henceforth be required to make frequent disclosures. If Oanda and other top-tier brokers accede to competitive pressures and also go public, the result should be increased transparency for the industry and better pricing for traders. In short, daily volume figures ($4 Trillion/day) notwithstanding, retail forex trading still has a ways to go before it can really be compared to retail stock trading.

IPOs Raise Questions about the Future of Retail Forex

It has been said before, but now I think it’s official: retail forex has entered the mainstream. In the month of December, two retail forex brokerages – Forex Capital Markets (FXCM) and Gain Capital Holdings (GCAP) – went public on the New York stock exchange. Combined with some juicy information revealed in their regulatory filings, I think this raises interesting questions about the future of forex.

Some background: both FXCM and Gain Capital operate trading platforms and news/analysis websites (DailyFX.com and Forex.com, respectively). FXCM has a current market capitalization of $850 million, compared to $250 million for Gain Capital. The former earned net income of $98 million last year on revenue of $339 million, and it has 135,000 active clients. The latter earned $36 million net income on $188 million revenue, and its client base totals 52,000. (For the sake of comparison, consider that ETrade has more than $4 million and its ttm revenues exceeded $2.5 Billion).

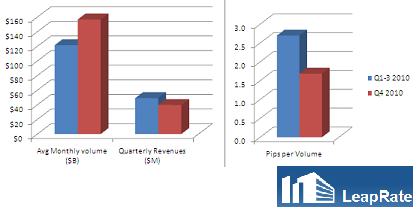

If you do some simple arithmetic, you quickly discover that revenue per account is substantially higher for forex brokers than for stock brokers: $2,500 in the case of FXCM compared to $100-200 that I’ve been told is standard for retail stock brokers. Of course, some of that is to be expected, given that the average forex account-holder trades at a higher frequency and higher volume than stock investors, which apparently only make one round-trip trade per month, on average. While information on average account size was

not released, it nonetheless stands to reason that a significant portion of forex account-holder equity is being “transferred” to brokers every year. (Interestingly, FXCM loses money on the majority of its accounts. Accounts worth more than $10K – which presumably do the most trading – generate the most revenue, and yet more than half of them are still unprofitable for FXCM).

I think this raises some serious questions about transparency in forex commissions. While other brokers make money from the bid/ask spread (which also suffers from a lack of transparency) and by taking offsetting positions, “FXCM makes an identical amount of money in the form of pip markups (which are really commissions) regardless of whether the customer made or lost money on the account.” Basically, FXCM matches up buyers/sellers with banks and financial institutions, and takes a cut for facilitating the transaction. While this is somewhat less opaque than filling orders directly for customers, the fact that it doesn’t disclose its commissions should be cause for concern. For the sake of comparison, consider that when you buy/sell stock, the commission that you pay the broker is clearly disclosed.

Someone recently asked me if trading commissions (i.e. spreads) in forex were fair/stable, and in the context of this data, I think it shows that there are is still room for commissions to fall further. As the number of retail forex traders grows, you would expect spreads to tighten further, and profit/account to decline from the current level of $700+ per year.

Since both FXCM and Gain Capital are now public companies, they will be subject to increased scrutiny and regulatory oversight, and will henceforth be required to make frequent disclosures. If Oanda and other top-tier brokers accede to competitive pressures and also go public, the result should be increased transparency for the industry. As of yet, I think that daily volume figures ($4 Trillion/day) notwithstanding, retail forex trading still has a ways to go before it can really be compared to retail stock trading.IPOs Raise Questions about the Future of Retail Forex

It has been said before, but now I think it’s official: retail forex has entered the mainstream. In the month of December, two retail forex brokerages – Forex Capital Markets (FXCM) and Gain Capital Holdings (GCAP) – went public on the New York stock exchange. Combined with some juicy information revealed in their regulatory filings, I think this raises interesting questions about the future of forex.

Some background: both FXCM and Gain Capital operate trading platforms and news/analysis websites (DailyFX.com and Forex.com, respectively). FXCM has a current market capitalization of $850 million, compared to $250 million for Gain Capital. The former earned net income of $98 million last year on revenue of $339 million, and it has 135,000 active clients. The latter earned $36 million net income on $188 million revenue, and its client base totals 52,000. (For the sake of comparison, consider that ETrade has more than $4 million and its ttm revenues exceeded $2.5 Billion).

If you do some simple arithmetic, you quickly discover that revenue per account is substantially higher for forex brokers than for stock brokers: $2,500 in the case of FXCM compared to $100-200 that I’ve been told is standard for retail stock brokers. Of course, some of that is to be expected, given that the average forex account-holder trades at a higher frequency and higher volume than stock investors, which apparently only make one round-trip trade per month, on average. While information on average account size was

not released, it nonetheless stands to reason that a significant portion of forex account-holder equity is being “transferred” to brokers every year. (Interestingly, FXCM loses money on the majority of its accounts. Accounts worth more than $10K – which presumably do the most trading – generate the most revenue, and yet more than half of them are still unprofitable for FXCM).

I think this raises some serious questions about transparency in forex commissions. While other brokers make money from the bid/ask spread (which also suffers from a lack of transparency) and by taking offsetting positions, “FXCM makes an identical amount of money in the form of pip markups (which are really commissions) regardless of whether the customer made or lost money on the account.” Basically, FXCM matches up buyers/sellers with banks and financial institutions, and takes a cut for facilitating the transaction. While this is somewhat less opaque than filling orders directly for customers, the fact that it doesn’t disclose its commissions should be cause for concern. For the sake of comparison, consider that when you buy/sell stock, the commission that you pay the broker is clearly disclosed.

Someone recently asked me if trading commissions (i.e. spreads) in forex were fair/stable, and in the context of this data, I think it shows that there are is still room for commissions to fall further. As the number of retail forex traders grows, you would expect spreads to tighten further, and profit/account to decline from the current level of $700+ per year.

Since both FXCM and Gain Capital are now public companies, they will be subject to increased scrutiny and regulatory oversight, and will henceforth be required to make frequent disclosures. If Oanda and other top-tier brokers accede to competitive pressures and also go public, the result should be increased transparency for the industry. As of yet, I think that daily volume figures ($4 Trillion/day) notwithstanding, retail forex trading still has a ways to go before it can really be compared to retail stock trading.

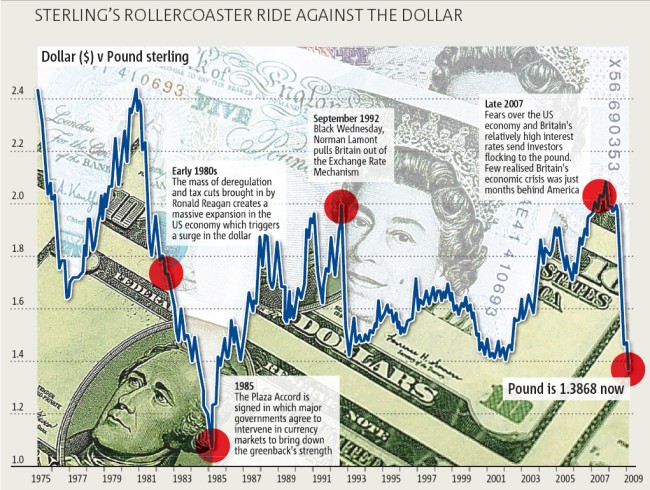

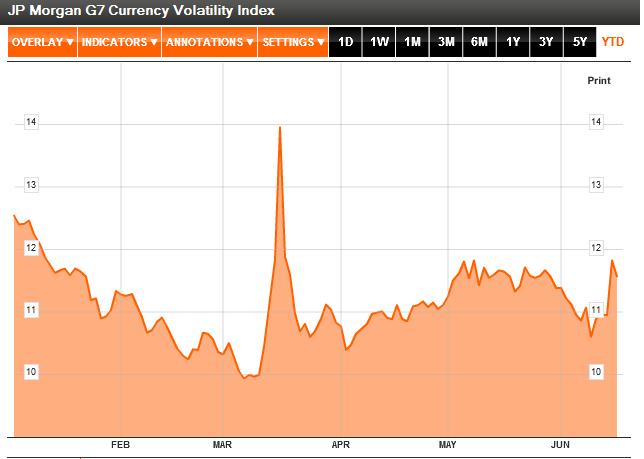

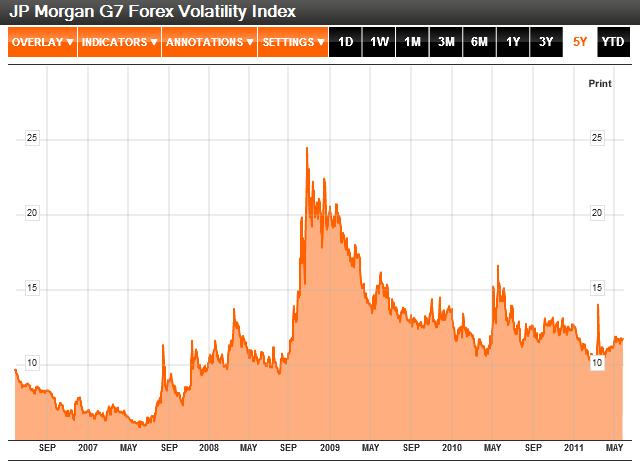

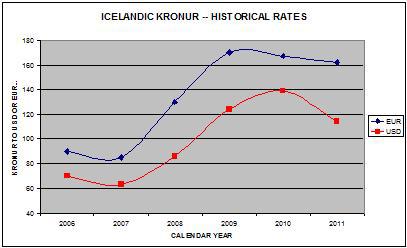

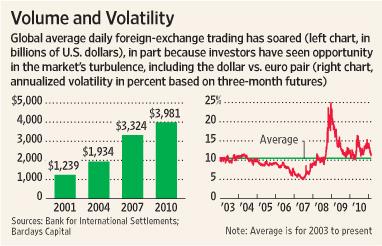

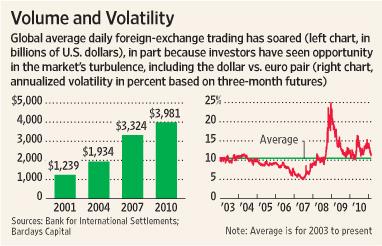

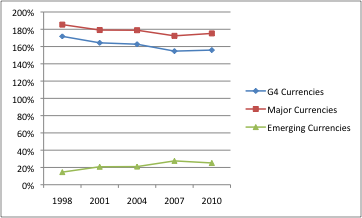

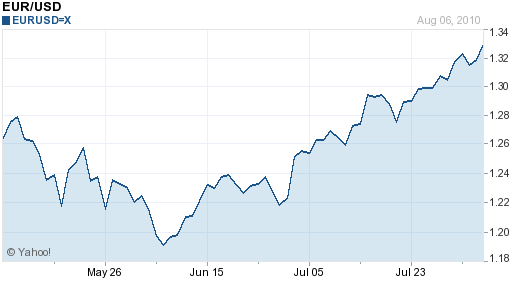

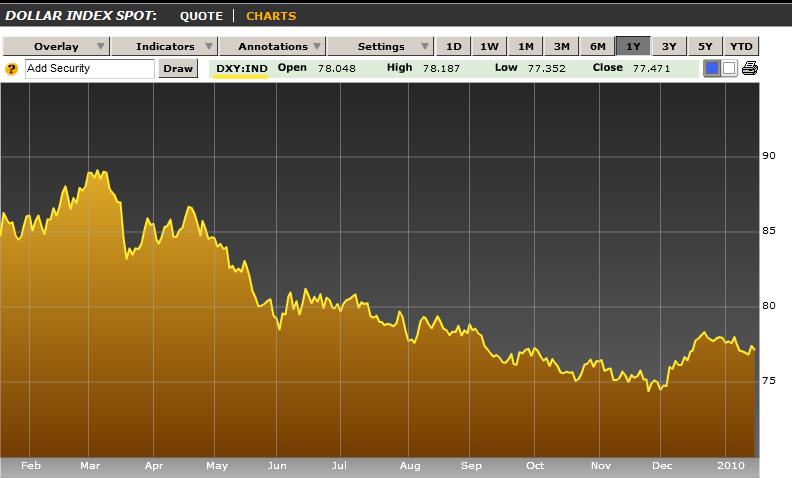

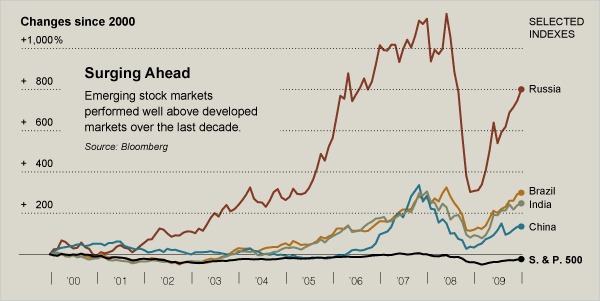

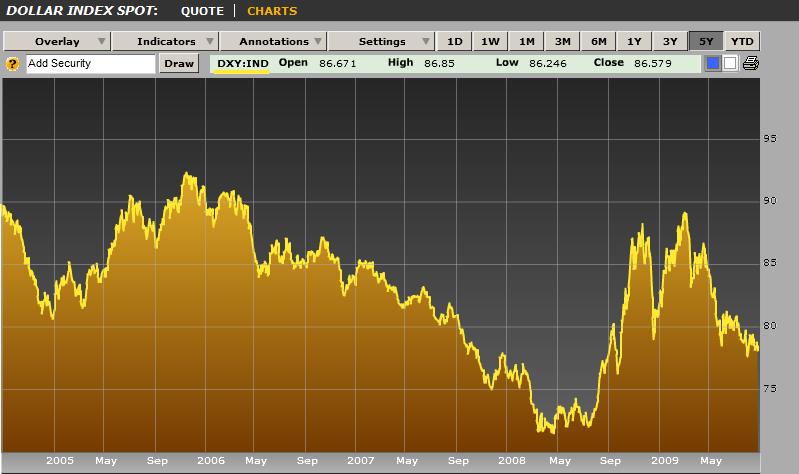

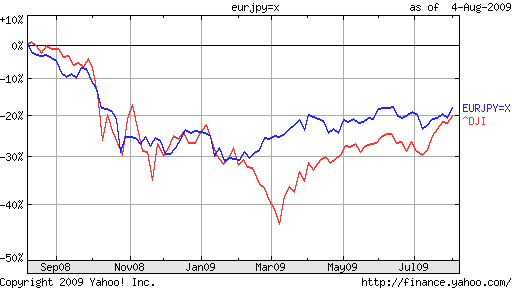

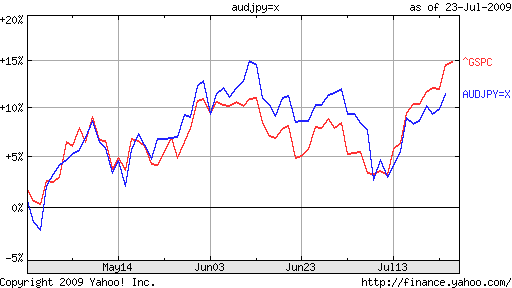

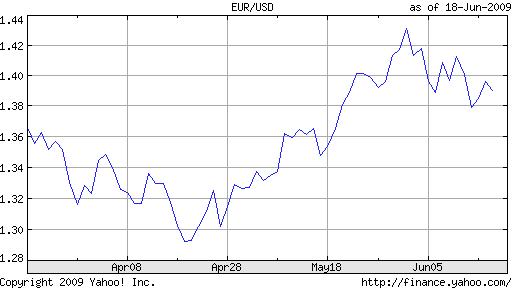

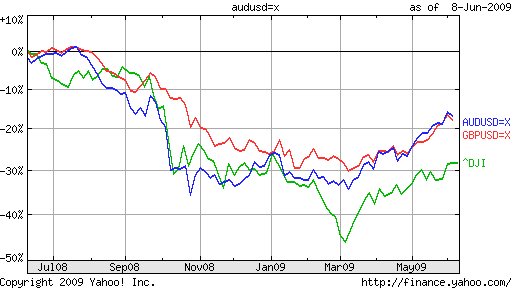

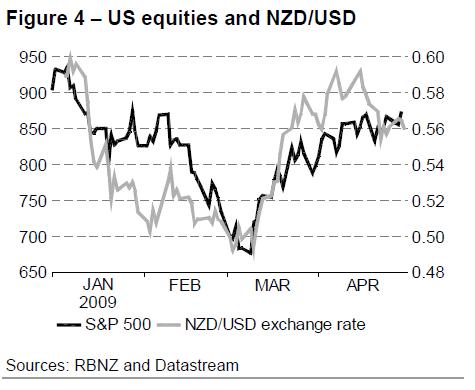

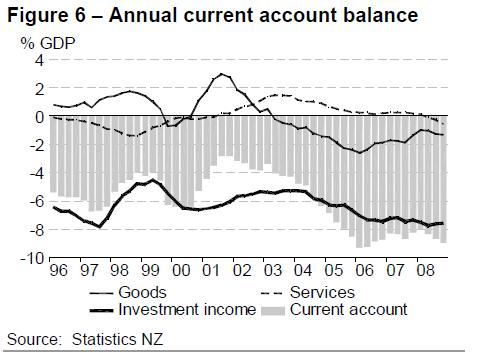

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.

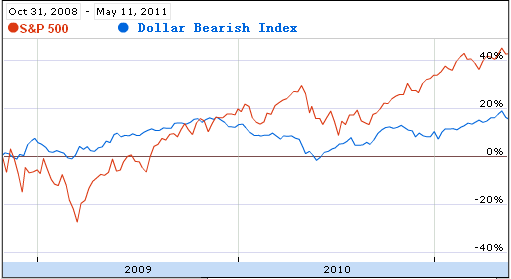

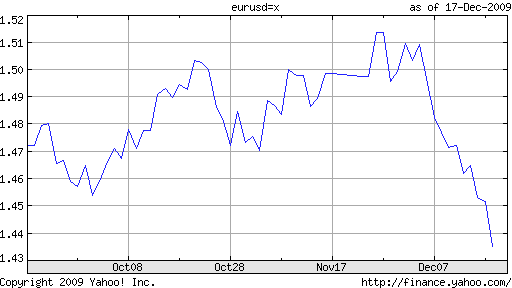

As a result, investors are rushing to reverse their short EUR/USD bets. What started as a minor correction – and inevitable backlash to the record short positions that had built up in April/May – has since turned into a flood. As a result, shorting the Dollar as part of a carry trade strategy is back in vogue. According to

As a result, investors are rushing to reverse their short EUR/USD bets. What started as a minor correction – and inevitable backlash to the record short positions that had built up in April/May – has since turned into a flood. As a result, shorting the Dollar as part of a carry trade strategy is back in vogue. According to

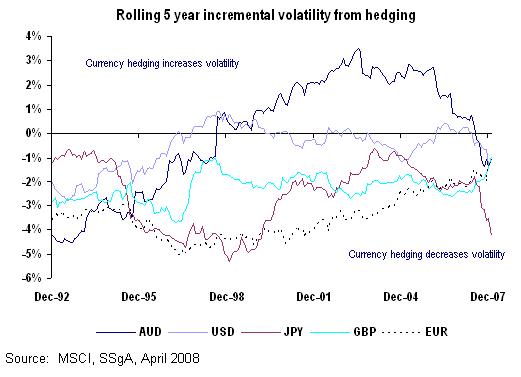

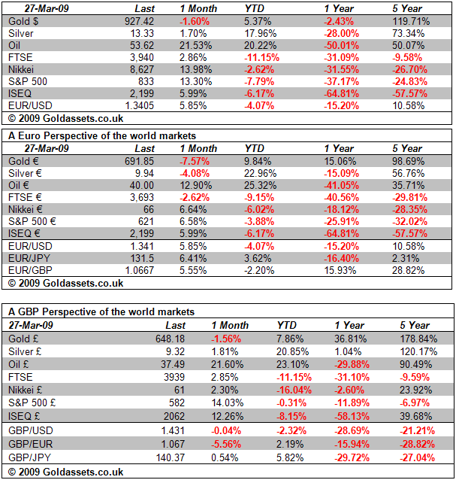

Generally speaking, there are a few situations in which currency hedging is useful: international equity/bond investing, currency investing/trading, and inflation hedging. The latter typically involves using commodities/metals to hedge against inflation, which is typically proxied by the Dollar. In other words, inflation hawks might buy gold/oil to offset a declining Dollar. This dynamic is currently on display in commodities markets, where “Speculative money has increased

Generally speaking, there are a few situations in which currency hedging is useful: international equity/bond investing, currency investing/trading, and inflation hedging. The latter typically involves using commodities/metals to hedge against inflation, which is typically proxied by the Dollar. In other words, inflation hawks might buy gold/oil to offset a declining Dollar. This dynamic is currently on display in commodities markets, where “Speculative money has increased

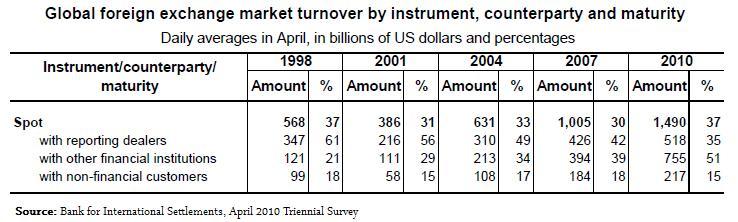

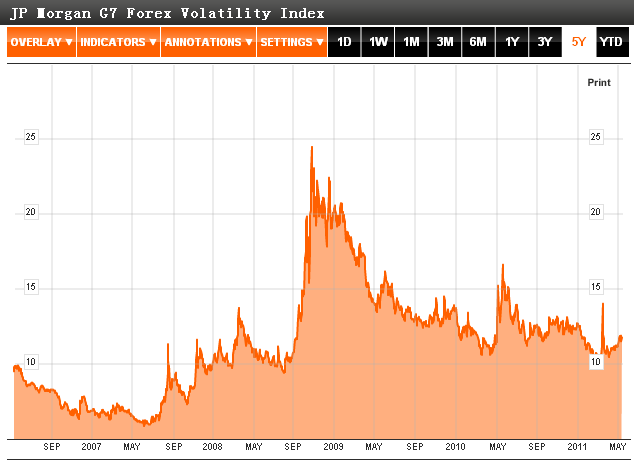

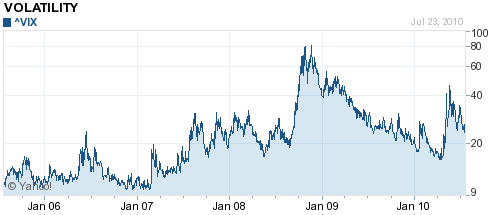

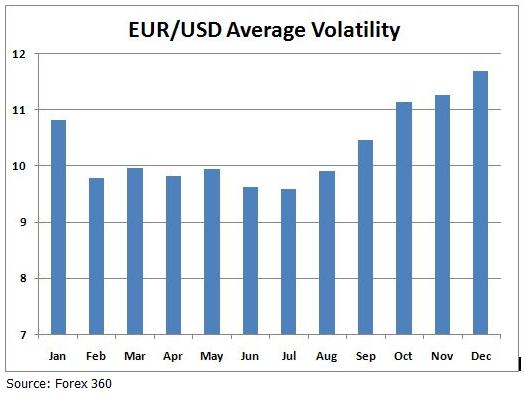

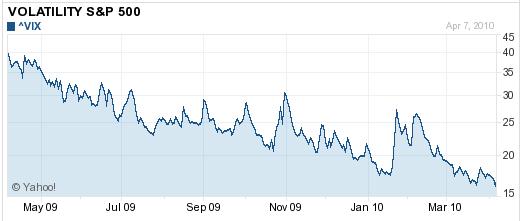

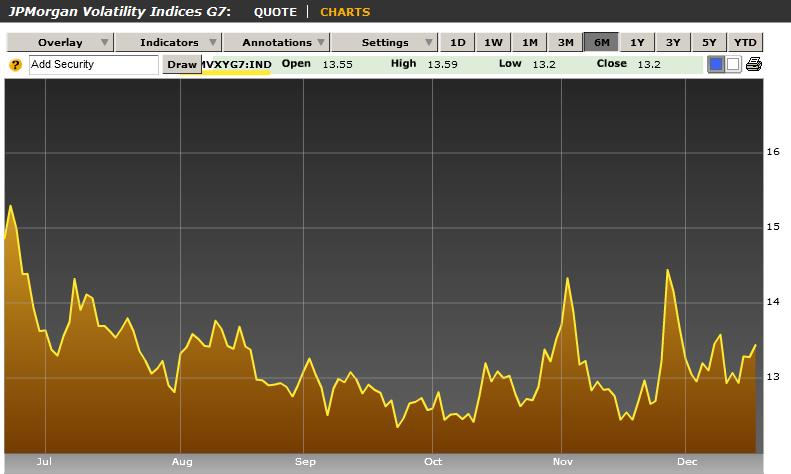

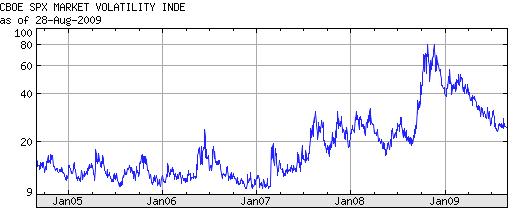

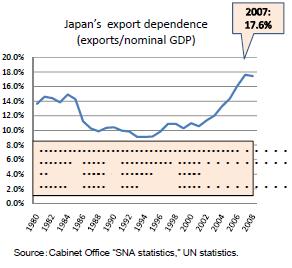

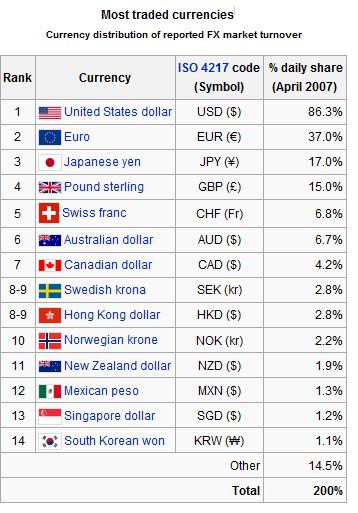

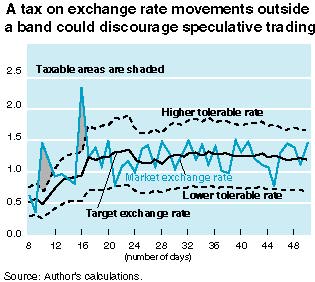

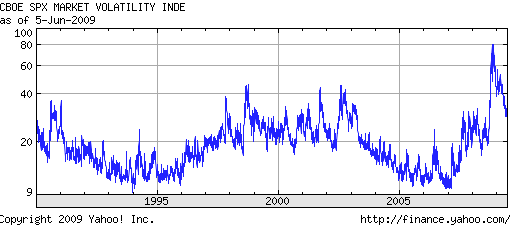

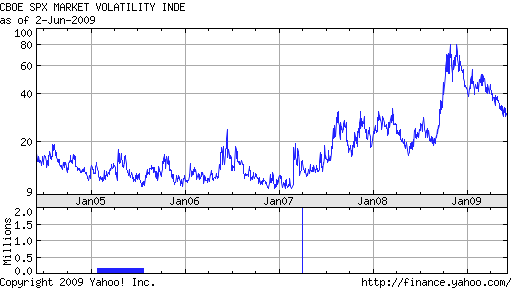

While still a fringe idea, the tax initially gained momentum following the 1997 Southeast Asian economic crisis, and has found new followers in the wake of the ongoing credit crisis. Consider the unprecedented volatility in currency markets of late, manifested in wild daily fluctuations.

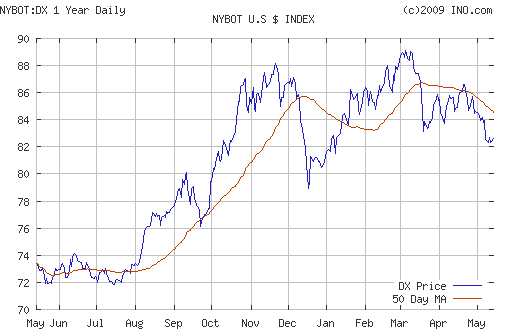

While still a fringe idea, the tax initially gained momentum following the 1997 Southeast Asian economic crisis, and has found new followers in the wake of the ongoing credit crisis. Consider the unprecedented volatility in currency markets of late, manifested in wild daily fluctuations. Even the US Dollar, the world’s reserve currency, has been on a veritable roller coaster of late, rising and falling by 10% in a matter of months. Prior to the rise of forex speculation (already a $1 Quadrillion/year market!), it was rare for a currency to move that much in a year. Given that such speculation probably accounts for 90% of daily turnover, it seems obvious as to who is causing this volatility.

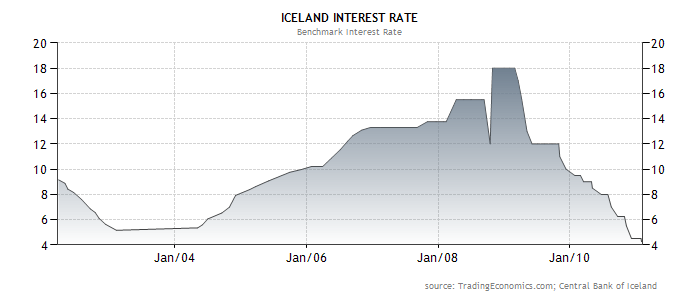

Even the US Dollar, the world’s reserve currency, has been on a veritable roller coaster of late, rising and falling by 10% in a matter of months. Prior to the rise of forex speculation (already a $1 Quadrillion/year market!), it was rare for a currency to move that much in a year. Given that such speculation probably accounts for 90% of daily turnover, it seems obvious as to who is causing this volatility. Don’t get me wrong; there’s a role for speculation in the forex markets, just like there’s a role for speculation in all securities markets. When markets function efficiently and players act rationally, currences should and will reflect economic fundamentals and act to minimize global imbalances. Due to the rise of the carry trade and the herd mentality, however, the oppose often obtains in practice. This can cause currency runs and or artificially inflated currencies that compel Central Banks to act counter to the way they otherwise would (i.e. by raising interest rates rapidly to deter capital flight, crimping economic growth.)

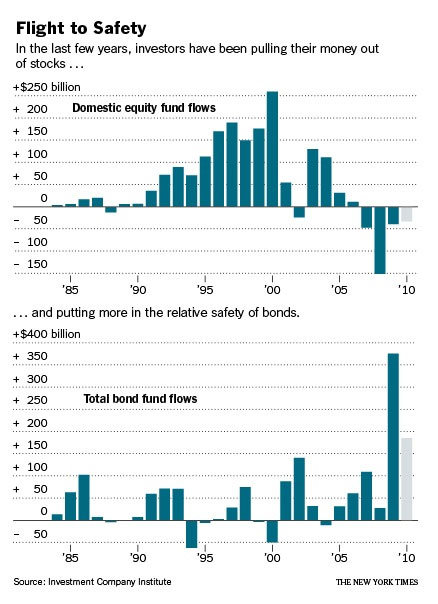

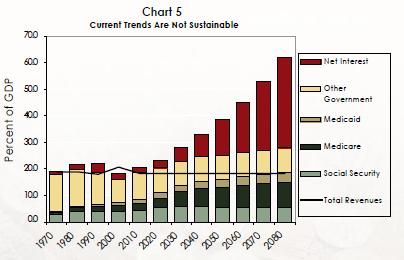

Don’t get me wrong; there’s a role for speculation in the forex markets, just like there’s a role for speculation in all securities markets. When markets function efficiently and players act rationally, currences should and will reflect economic fundamentals and act to minimize global imbalances. Due to the rise of the carry trade and the herd mentality, however, the oppose often obtains in practice. This can cause currency runs and or artificially inflated currencies that compel Central Banks to act counter to the way they otherwise would (i.e. by raising interest rates rapidly to deter capital flight, crimping economic growth.) If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

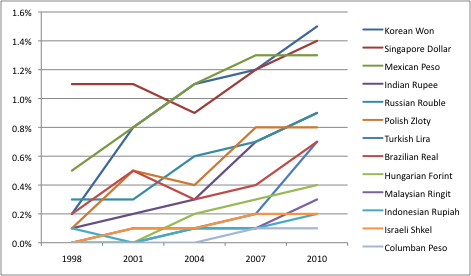

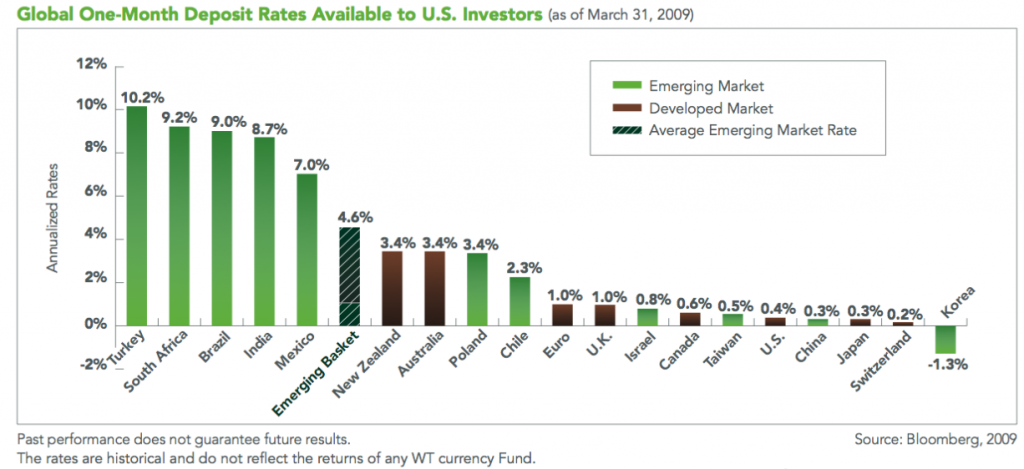

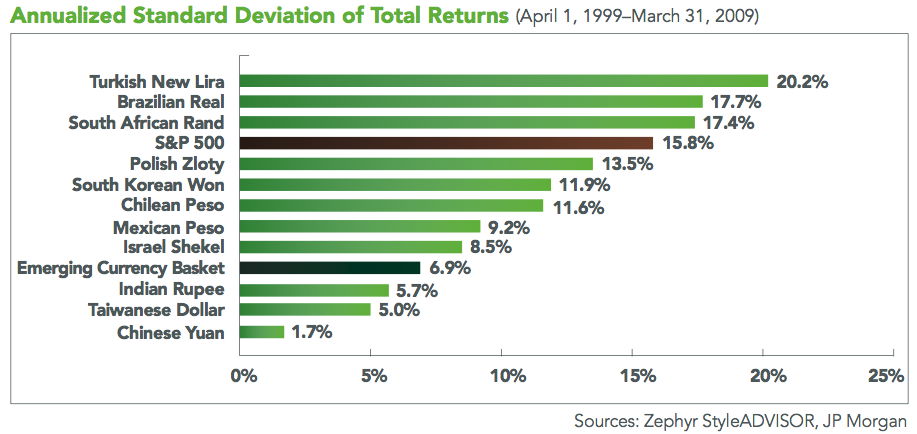

Chosen from three regions (Latin America, Africa/Europe/Middle East, and Asia), the inaugural 11 currencies are as follows: Brazilian real, Chinese yuan, Chilean peso, Indian rupee, Israeli shekel, Mexican peso, Polish zloty, South African rand, South Korean won, Taiwanese dollar and Turkish new lira. According to WisdomTree, these currencies were selected not necessarily for economic reasons, but rather because of their relatively high liquidity and low correlation with each other. In addition, “The selected currencies are

Chosen from three regions (Latin America, Africa/Europe/Middle East, and Asia), the inaugural 11 currencies are as follows: Brazilian real, Chinese yuan, Chilean peso, Indian rupee, Israeli shekel, Mexican peso, Polish zloty, South African rand, South Korean won, Taiwanese dollar and Turkish new lira. According to WisdomTree, these currencies were selected not necessarily for economic reasons, but rather because of their relatively high liquidity and low correlation with each other. In addition, “The selected currencies are

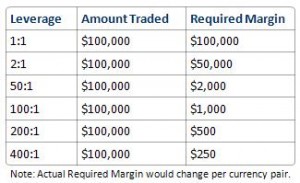

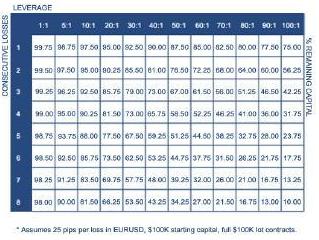

While traders can theoretically use margin to trade any kind of financial instrument/security, leverage is especially common in forex. The reason is that currencies are typically bought and sold in units of 50,000 – 100,000, which is more than retail traders can afford, or are willing to commit. Moreover, currencies are not as volatile (outside of the credit crisis, that is) as other securities, and typically don’t fluctuate more than 1% in a given day. Changes are often so minuscule that 1/10000 of a unit (one Pip) has become the benchmark for measuring fluctuations. Accordingly, “currency transactions must be

While traders can theoretically use margin to trade any kind of financial instrument/security, leverage is especially common in forex. The reason is that currencies are typically bought and sold in units of 50,000 – 100,000, which is more than retail traders can afford, or are willing to commit. Moreover, currencies are not as volatile (outside of the credit crisis, that is) as other securities, and typically don’t fluctuate more than 1% in a given day. Changes are often so minuscule that 1/10000 of a unit (one Pip) has become the benchmark for measuring fluctuations. Accordingly, “currency transactions must be  To give you an idea as to how excessive forex leverage has become, consider that the Financial Industry Regulatory Authority (FINRA) recently submitted a

To give you an idea as to how excessive forex leverage has become, consider that the Financial Industry Regulatory Authority (FINRA) recently submitted a